Conventional loan calculator how much can i borrow

Since you have built no equity up to that point you can expect to have a significantly increased payment as you try to catch up on the principle. You can view loan amount limits in your local area here.

Va Loan Mortgage Loan Originator Va Loan Home Loans

It allows non-borrowing members of the.

. For home buying the Rent vs. Sometimes known as loan term the length of the loan is the number of years until your home loan is paid in full. In many cases homebuyers can borrow up to 548250 with a VA loan but you may be able to borrow more in areas with a higher cost of living.

The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period. The 366 days in year option applies to leap years otherwise.

Buy Calculator considers one-time costs closing costs and the down payment and ongoing expenses like property taxes. To calculate how much home you can afford simply follow these five steps. 760-850 score 84000.

To obtain a conventional loan many lenders prefer to approve a credit score of 680 and above though some might approve a score as. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Loan Type Front End Limit Back End Limit.

Most new homebuyers will consider taking out a conventional mortgage loan. This mortgage insurance can be. Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI.

Cant get approved via Automated Underwriting System if above 469. Many lenders may have tighter standards. Many conventional loans are made with as little as 3 down.

Before applying for a mortgage you can use our calculator above. Use our home affordability calculator to find out how much house you can afford. Lenders can count VA disability income and certain military allowances to determine how much you can borrow with a VA loan.

With a construction-to-permanent loan you borrow money to pay for the cost of building your home and once the house is complete and you move in the loan is converted to a permanent mortgage. You can calculate your mortgage qualification based on income purchase price or total monthly payment. For 2021 the baseline conforming conventional loan limit for one-unit properties is 548250.

Active duty service members receiving Basic Allowance for Housing BAH can use this income to pay for part or even all of their monthly mortgage payment. Second mortgages come in two main forms home equity loans and home equity lines of credit. How expensive of a home can I afford with an FHA loan.

The HomeReady mortgage program is one such option. Its a good indicator of whether you satisfy minimum requirements to qualify for. 4 Its called baseline because the maximum amountor limityou can borrow is adjusted every year to match housing-price changes.

The standard down payment percentage is 20 however certain loans allow for a down payment much lower than that in some cases as low as 0 VA Loan or 35 FHA Loan. 43 with FICO below 620. In 2022 the FHA.

To calculate how much house you can afford use the 25 rule. FHA-insured loans are meant to help people with low or no credit high debt or low funds qualify for a mortgage. Loan limits for conforming conventional loans are set by the FHFA.

Second mortgage types Lump sum. Loans can be used for regular manufactured or modular homes which are no more than 2000 square feet in size. Other types of military allowances that can count as effective income include.

Borrowers with FICO above 620 can exceed 50 up to 569 with compensating factors. Any borrower with a conventional loan who puts less than 20 down is required to buy private mortgage insurance PMI which raises the annual cost of the loan. In some cases you may get negative amortization with an interest-only loan.

801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment. Some conventional loan programs allow you to put down as little as 3 percent to 5 percent but the tradeoff is youll need to pay for private mortgage insurance PMI a cost added on to your. These loans typically require.

All inputs and options are explained below. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. At the end of the loan you have to either get another interest-only loan or you have to get a conventional loan.

Calculate how much house you can afford with our home affordability calculator. Using the same FICO loan savings calculator in the example above heres how much the calculator estimated youd spend on interest in total based on credit score. Removes PMI on a conventional loan.

To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t. Conventional loans with just 3 down. This provides a rough estimate of how much you can borrow for a loan.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Figure out 25 of your take-home pay. The effective loan limit starts at 265400 in low-cost areas and goes as high as 631000 in expensive or high-cost areas in states like California.

This provides a ballpark estimate of the required minimum income to afford a home. Never spend more than 25 of your monthly take. Many lenders require 31 or below.

To calculate how much you can afford you need your gross monthly income monthly debts down payment amount your home state credit rating and loan type. Most mortgages have a loan term. Factor in income taxes and more to better understand your ideal loan amount.

The current maximum is 647200 in most US. Both the FHA and conventional loans have limits on the amount of money you can borrow. Interest Rate Interest rate also known as a mortgage.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

5 Best Mortgage Calculators How Much House Can You Afford

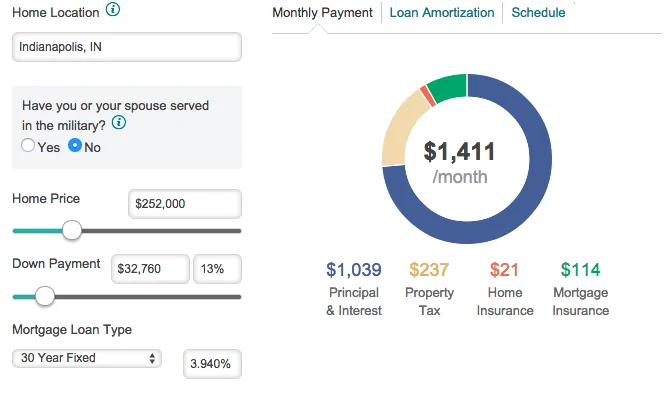

Va Mortgage Calculator Calculate Va Loan Payments

Mortgage Calculator Money

Can I Afford To Buy A Home Mortgage Affordability Calculator

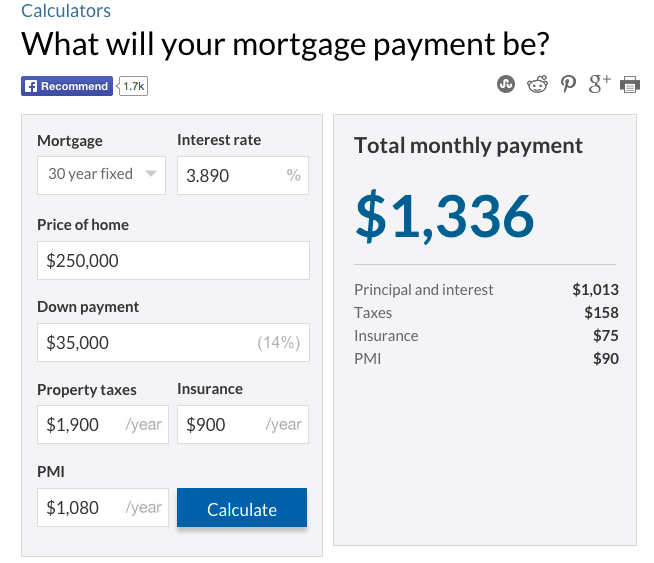

Mortgage Calculator How Much Monthly Payments Will Cost

Loan Calculator That Creates Date Accurate Payment Schedules

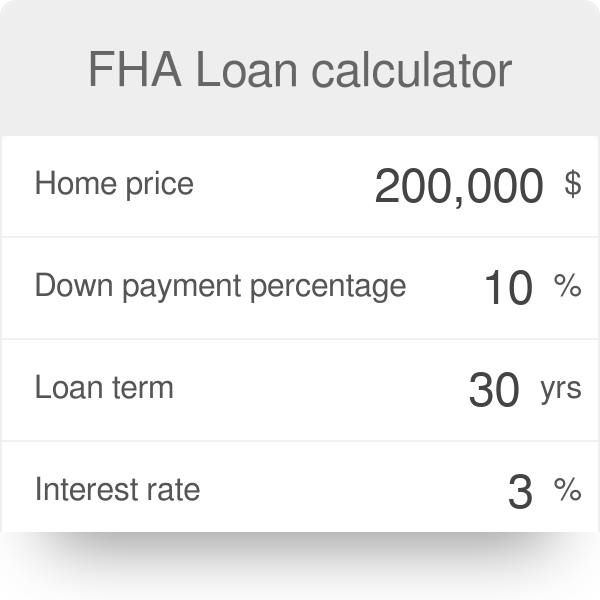

Fha Loan Calculator

Loan Calculator That Creates Date Accurate Payment Schedules

Home Affordability Calculator Credit Karma

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

5 Best Mortgage Calculators How Much House Can You Afford

Fha Loan Calculators

Mortgage Calculator How Much Monthly Payments Will Cost

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Usda Home Loan Qualification Calculator Freeandclear

Va Loan Calculator Estimate Your Monthly Mortgage Payment And Va Funding Fee The Military Wallet